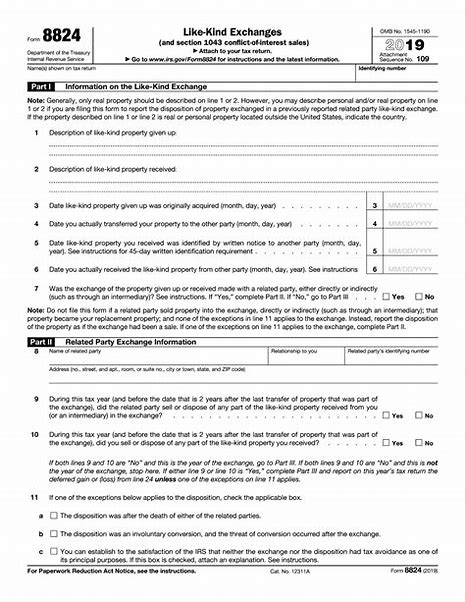

1031 Like Kind Exchange Analysis

With respect to your proposed §1031 "like kind" exchange transaction, We will render the following "provided services" to you as part of this engagement: 1. Provide an analysis that applies relevant tax law to the fact pattern that you provide. We will then provide our conclusions regarding: Whether the proposed transaction will meet the requirements for a §1031 "like kind" exchange; and If the transaction will meet the requirements for a "like kind" exchange, whether the transaction will generate any taxable "boot," rendering the transaction partially taxable. 2. Provide you with information regarding when the various steps of the "like kind" exchange must be completed.